Housing acts and rules: Construction, land and ownership

Identify the property

First of all, identify the plot where you plan to construct the building. Consult your architect and prepare a sketch that complies with the Kerala Municipality Building Rules (KMBR) or Kerala Panchayat Building Rules (KPBR) according to the jurisdiction under which your property falls.The sketch should include the following details:

- Site layout

- Building elevation

- Sections

- Site plan (plot width, setbacks, access road width)

- Floor plan (all floors)

- Roof or terrace plan

- Details of septic tank and soak pit

- Location plan

An application for a building permit in Kerala should also cite details like Site location, whether the property is for Residential or commercial use, An Index of all drawings submitted, Number of sheets, Date, Names of Draftsman & Reviewer, Scale, Location details including details of Village/Thaluk/District, Survey number and resurvey number of the property, Ward number, Extent (in arcs and cents), Proposed building area, Plinth and carpet area of all floors, Plinth and carpet area of the car porch, Total area, Coverage, FAR (Floor Area Ratio is calculated as the ratio of the Total floor area on all floors to The Plot Area), Permit area, Joinery schedule etc.

Get documents up-to-date

While the Architect works on Step 1, you should also get the following documentation related to the property up to date

- Possession certificate (This is an online document) – Possession certificate is a document which a property seller gives to a buyer stating the possession date of the property. Possession certificate is issued by concerned Tahsildar in Rural areas and RDO in urban areas. Possession is mandatory to include the property in the revenue records. Further, possession certificate is required to secure a loan.

Apply through e-District Portal

The applicant can follow below mentioned step by step guidelines to apply for the certificate online through the e-District portal.

Step 1: Visit the main page of the e-District portal of Government of Kerala.

Step 2: To avail e-District certificate services, the applicant has to register in this web portal.

Register in e-District Portal

Step 3: To register in the e-District portal, click on the ‘Portal user registration’ option from the main page. The page will redirect to next page.

Step 4: The applicant needs to fill personal details and select the login name and password.

Step 5: Select the password recovery question and provide an answer for the selected question

Step 6: Click on validate button and further to register button. Now the applicant can avail online certificate services by login to the e-district portal using the username and password.

One Time Registration

Step 7: After login to the portal, do a onetime registration to apply for possession certificate.

Step 8: Click on the one-time registration button. Fill all mandatory details and click on the duplicate button.

Note: One-time registration process is to find out whether the applicant has already registered through any Akshaya Centers, i.e. duplicate check.

Step 9: After the successful duplicate check, the submit button will be enabled. The applicant can click on the submit button to register.

Step 10: Click on the applicant registration link, in the new page select the duplicate link, the system will automatically check the duplicate application if any.

Step 10: After verification, click on Submit to proceed to apply.

Enter Detail

Step 12: Enter all details for the certificate such as e-District registration number, name, certificate type and purposes.

Step 13: To save details, click on the save button. The applicant will be redirected to the new page for uploading documents.

Upload Documents

Step 14: Upload all required documents (mentioned above) in PDF format with 100KB.

Step 15: After uploading all required documents make payment.

Note: Before making payment, check all entered data.

Make Payment and Generate Receipt. The applicant can see the fee for the certificate; it will appear on the screen:

Step 16: The applicant can pay the fee by any of the following methods.

- Debit card payment

- Credit Card Payment

- IMPS

- Wallets

- Net banking

- Cash-card prepaid

Step 17: After successful payment of fee, the applicant can print the receipt and the certificate application.

Download Certificate

Status of possession application will be displayed on the transaction history tab in the e-District portal also the applicant will get SMS regarding the status of the application.

Step 18: After receiving the ‘Your Possession Certificate has been issued’ SMS on the registered mobile number, again login into the e-District portal. Download and take a print out of the digitally signed certificate.

You can apply for possession certificate through Akshaya Center also

- Latest land tax receipts

- Copy of the “Aadharam” or Title Deed

- Location sketch

- Non objection certificate if multiple land owners are present (if any)

- Death certificate if the land deed is in the name of a late person (if any)

Get online approval from the local self-governing body

Application for a building permit can be made only by a licensee at the Local Self-governing body (Panchayat, Municipality or Corporation) under whose jurisdiction the property falls. The licensee could be an Architect, a licensed draftsman or a licensed engineer.

The documents mentioned in step 1 and 2 above are then handed over to the licensee. The licensee then applies for an online approval for the building permit (e-filing) at the local self-governing body office.

Acknowledgement from the local self-governing body

The application has to be acknowledged by the authorities concerned at the local self-governing body.

Submission of the Building Permit application by a licensee

Hard copies of the following documents should be filed and submitted by the licensee.

List of documents for a Building permit application.

- Possession certificate (This is an online document)

- Latest land tax receipts

- Copy of the “Aadharam” or Title Deed

- 3 copies of the Sketch or Sanction drawing

- Copy of Architect’s or Licensee’s licence

- Online acknowledgment certificate issued by the local self-governing body

- Location sketch

- Non objection certificate if multiple land owners are present (If any)

Death certificate if the land deed is in the name of a late person (if any) – As per the Registration of Birth & Deaths Act, 1969 every death has to be registered with the concerned State Government. Death Certificate is an important document issued by the Government to the nearest relatives of the deceased. A person’s death in Kerala needs to be registered in the Concern Registrar Office to get Death Certificate. The below-mentioned person can report or register a person’s death: Documents necessary for death registration in Kerala are:

- Proof of birth of the deceased – Birth certificate or SSLC certificate

- An affidavit specifying the date and time of death

- Copy of the ration card

- Application form for registration

- Medical Certification of causes of death, if required

Submit the file containing these documents at the local self-governing body. You should submit the relevant original documents also for verification. The local self-governing body office will then issue a file number for your application.

Verification by the Building Inspector

The Building Inspector (BI) will then visit your property, assess the veracity of the information provided in your application and submit the report to the Assistant Engineer (AE).

Verification by the Assistant Engineer

The AE will then perform another round of verification and submit the report to the Assistant Executive Engineer (AXE).

Approval of the application

The AXE then approves or rejects the application. For buildings up to 350 sq. m (~3700 sq. ft.), this would suffice. However for larger buildings there would be higher levels of scrutiny and would require further levels of approvals. This would differ from one local self-governing body to another.

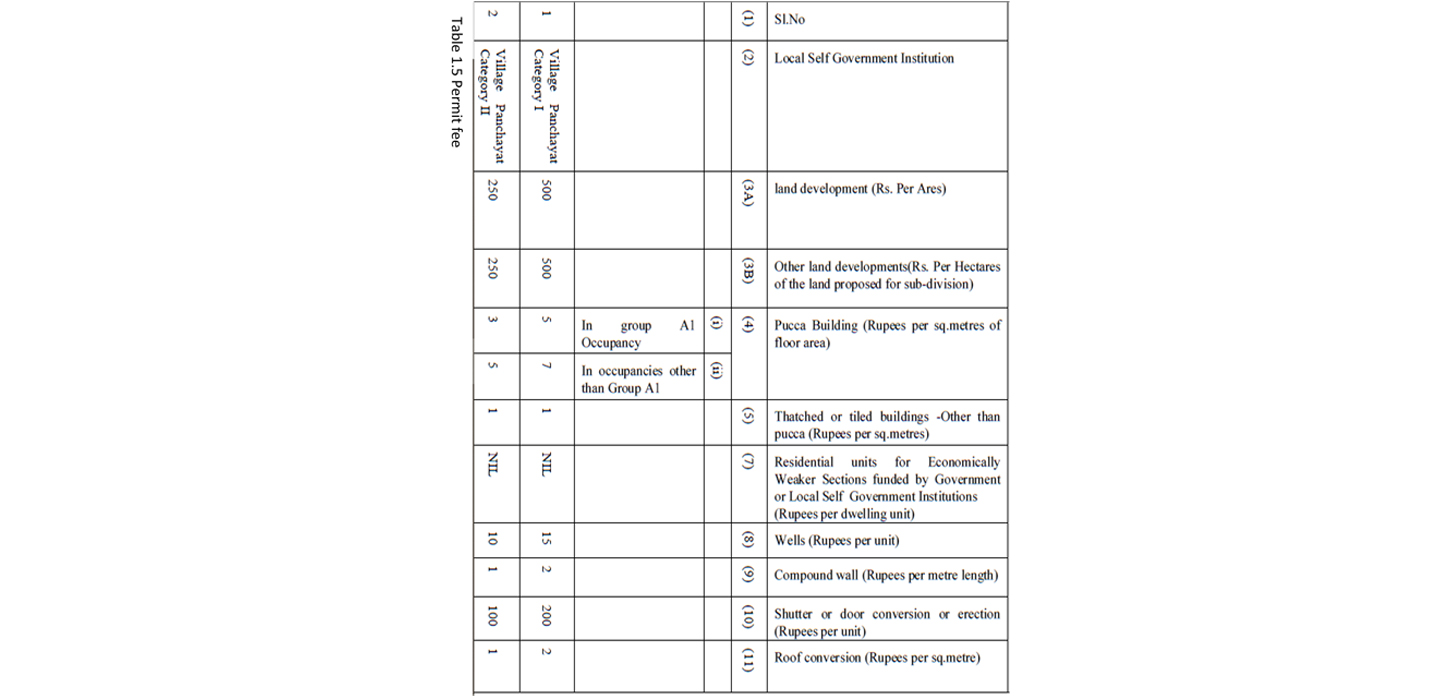

Fee payment and issue of building permit

Finally, for approved applications, you can submit the fees at the local self-governing body office. The

building permit will then be issued and sent to your registered address. The permit fee for various construction is given below:

Provided that, in the case of residential buildings up to 150 Sq metres of total built-up area in Category I Village Panchayats, the permit fee shall be only 50% of the amount mentioned above.

Note:- (1) Area of accessory buildings such as car shed, toilet, cabin for watch and ward etc. shall be added to main building for calculating the permit fee. In the case of addition or alteration, only the area of the portion added or altered shall be taken into account.

Criteria’s for getting house number

- Submit applications for getting house number and occupancy certificate in Town planning section of co-operation office

Documents needed

- House construction Completion certificate according to the plan of licensed architect or surveyor

- The permit obtained from the governing office before constructing the house

Building tax

- Taxes are amount of fixed percentage of rent that can be legally available if the building is rented.

- Taxes should be paid twice in a year as half yearly instalment. Taxes are applicable for all buildings except Central Government Institutions

- Building tax is not required for houses with area under 60 sq m

- Municipalities in Kerala are responsible for collecting Property tax.

- Property tax can be paid both Online as well as offline method

- The Kerala Property tax (Land / Building tax) is calculated and collected semi-annually as per assessment

- Property Tax is calculated as per plinth area calculation and charges vary with – Panchayat / Municipality / Corporation area.

Apply Online:

- The applicant can use online payment portal “Sanchaya” of Kerala Government

- In the given page, please select “Citizen Login” option to go to the online service page.

- Please select “Property tax (Payment for Reg. Users)”option to reach next page to login.

- If already a registered user, please login. Otherwise, create login id using new user registration option and fill the prompted details to create user id. Once logged in.

- The new page will have options to choose for different needs like enrol a building, Manage building list, online payment under Property tax option.

- Please select as per the requirement.

- Now we will select Manage Building List option to get a list of building enrolled.

- If the details are appropriate, then please hit online payment option as provided on the left hand side.

- The resulting screen gives list with pay now option. Please hit Pay now option to reach a new page with the details of property, property owner and relevant information about property and amount to pay.

- Here please hit “Pay Now” to make payment using payment gateway.

- Payment gateway page will prompt user to select options ( Credit / Debit / Net Banking) to make online payment.

- The resulting screen will display Transaction Details. Please keep it for future reference.

- After successful payment you get confirmation message and online payment receipt on your registered mobile number and E- mail

National rehab and resettlement policy 2007

The revised National Rehabilitation and Resettlement Policy, 2007 formulated by the Ministry of Rural Development has been approved by the Cabinet on 11th Oct., 2007 and the same has been published in the Gazette of India on 31st Oct., 2007. The revised policy has been placed in the public domain at the websites of the Ministry of Rural Development and Department of Land Resources. Some highlights of the revised policy are:

- Policy covers all cases of involuntary displacement.

- Social Impact assessment (SIA) introduced for displacement of 400/200 or more families in plain/tribal, hilly, Scheduled areas, etc.

- Consultations with Gram Sabhas or public hearing made compulsory;

- Principle of rehabilitation before displacement;

- If possible, land for land as compensation;

- Skill development support and preference in project jobs ( one person per nuclear family );

- Rehabilitation Grant in lieu of land/job;

- Option for shares in companies implementing projects to affected families;

- Housing benefits to all affected families including the landless;

- Monthly pension to the vulnerable, such as disabled, destitute, orphans, widows, unmarried girls, etc.

- Monetary benefits linked to the Consumer Price Index; also to be revised suitably at periodic intervals;

- Necessary infrastructural facilities and amenities at resettlement areas;

- Periphery development by project authorities;

- Committees for each project, to be headed by Administrator for R &R.

- Ombudsman for Grievance Redressal;

- National Rehabilitation Commission for external oversight.

The revised policy covers all projects leading to involuntary displacement of people, and para 7.21 envisages special provisions for Scheduled Tribes and Scheduled Castes, the main features of which are given below:-

- Consultation with the concerned gram sabha or the Panchayats at the appropriate level in the Scheduled Areas under Schedule V of the Constitution in accordance with provisions of the Panchayats (Extension to the Scheduled Areas) Act 1996. Each Affected family of Scheduled Tribe followed by Scheduled Caste shall be given allotment of land for land, if Government Land is available in the resettlement Area.

- In case of land being acquired from the members of the Scheduled Tribes, at least one third of the compensation amount be paid at the outset as first instalment and rest at the time of taking the possession of the land.

- Additional one time financial assistance equivalent to five hundred days minimum agricultural wages for loss of customary rights or usage of forest produce.

- Scheduled Tribes to get free of cost land for community and religious gathering, to the extent decided by the appropriate government.

- Scheduled Tribes affected families resettled out of district to get twenty- five percentage higher benefits in monetary terms.

- Scheduled Tribes and Scheduled Castes affected families to be given fishing rights in the reservoir areas of the irrigation or hydel projects

- Scheduled Tribes and Scheduled Castes affected families enjoying reservation benefits in the affected areas shall be entitled to get the reservation benefits at the resettlement areas.

The Kerala Land Assignment Rules, 1964

In exercise of the powers conferred by Section 7 of the Kerala Land Assignment Act, 1960 (Act 30 of 1960), and in supersession of the rules for assignment of Government lands issued under notifications I and II G.O. (Press) No. 1029/Rev. dated 18-10-1958 published in the Kerala Gazette Extra Ordinary No. 107 as subsequently amended, the Government of Kerala hereby make the following Rules for the assignment of Government lands

Purposes for which land may be assigned:- Government lands may be assigned on registry for purposes of personal cultivation, house-sites and beneficial enjoyment of adjourning registered holdings

- The extent of Government land that shall be registered in favour of family as house site shall not exceed [twenty five cents (10 ares)]. The assignee shall be liable to pay land value for house sites at the rate of [Rs. 200 per acre] [40.47 Ares].]

- The extent of Government land that may be granted on registry when the same is indispensable required for the beneficial enjoyment of adjoining registered holding 1[shall not exceed, in the case of one registered holding twenty-five cents (10.12 ares)]. [Note- (1) The authority competent to assign land for beneficial enjoyment shall be the Revenue Divisional Officer. He may pass order of assignment in such cases only after personally satisfying himself that the land is absolutely necessary for that purpose.]

- 3. An assignment under sub-rule (2) shall be subject to the payment of market value of the land at the time of assignment and survey and demarcation charges at the rates specified sub-rule (4) of rule 10 excluding the value of improvements, if any, made by the occupants on the land].

Rights of disabled

Provisions for Differently-abled, Elderly and Children:- All buildings under occupancy groups A2, B,C,D, E,F and J which have access to the public and all apartment buildings/residential flats under occupancy group A1 shall be provided with the following facilities for the differently-abled, elderly and children:

(1) Every such building shall have easy access to the main entrance through a ramp.

(2) Every public building exceeding 1000 sq. metres and residential flats exceeding 2500 sq. metres built-up area shall have lift or separate approach through a ramp (intended for the differently-abled and elderly) to each floor. The minimum cage dimensions of such lift shall be as follows:

- Clear internal width 110 cm

- Clear internal depth 200 cm

- Entrance door width 90 cm

(3) The maximum gradient of any ramp approach intended for the differently-abled, elderly and children shall not exceed 1 in 12 and shall be finished with non slippery material. The minimum width of ramp shall be 120 cm. and provided with handrails of 80 cm height on both sides. Minimum gap from the adjacent wall to the hand rail shall be 50mm. The slope of all such ramps shall be constant within a building. Entrance landing shall be provided adjacent to ramp with the minimum dimension 120 cm x 150 cm.

(4) Toilets:-

A minimum of one special water closet shall be provided for the use of the differently-abled and elderly with essential provision of a wash basin at an easily accessible location with proper signage: Provided that in the case of such special toilets:

- These shall be provided at the ground floor for A1, A2, B, C, D, E, F & J (mentioned in building rules) occupancies and at every floor in multiples of three for A2, B, C, D, E, F& J occupancies.

- Minimum size of toilet shall be 1.50 m x 1.75 m.

- Minimum clear opening of the door shall be 90 cm. wide, the door shall swing out, or be sliding or folding type.

- Suitable arrangements of vertical/horizontal handrails with 5cm. clearance from the wall shall be provided in the toilet.

- The water closet seat shall be 50 cm. above from the floor level:

- At least one sink in each floor shall have a knee room of 70cm. high under the sink; and

- Locks of such toilet doors shall be of a type that can be opened from outside in case of emergency.

(5) Parking facilities

- 3% of the required parking subject to a minimum of one car space, shall be provided near the entrance, exclusively for use of the differently-abled with maximum travel distance of 30 metres, from the building entrance.

- The width of such parking bay shall be at least 3.6 metres.

(6) Walks and paths:

- Walks shall be smooth with hard level surface suitable for walking and wheeling. Avoid grates and manholes in walks. If grates cannot be avoided, then bearing bar shall be perpendicular to the travel path and opening between bars shall not be greater than 12mm in width.

- The walkway shall not cross vehicular traffic.

(7) In Group A2 Lodging Houses & Special Residential, one room for every 25 rooms or part thereof shall be set apart for the differently-abled.

(8) Other Special Treatments

- All obstructions and projections up to a minimum of 2.1 metre height from the finished floor level shall be avoided.

- Recoil doors shall be avoided, wherever there is access to the general public;

- Minimum & clear opening of the entrance door shall be 90 cm and it shall not be provided with a step that obstructs the passage of a wheel chair user.

- Appropriate signage’s shall be provided at salient locations for facilitating the differently-abled.

Rules and acts links

- http://www.sanchitha.ikm.in/book/export/html/654

- https://blog.Panchayatguide.in/2020/02/04/kerala-municipality-building-rules-2019-malayalam-by-c-s-santhosh

- https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=2ahUKEwjes9Xhg8HoAhXRzDgGHQBsC5IQFjAAegQIAhAB&url=https%3A%2F%2Fbuildingpermit.lsgkerala.gov.in%2Fcontent%2Frules%2Fkmbr_rule.pdf&usg=AOvVaw1bZKsqFIODzSnOSNEzwQ0H

House construction schemes

LIFE (Livelihood Inclusion and Financial Empowerment)

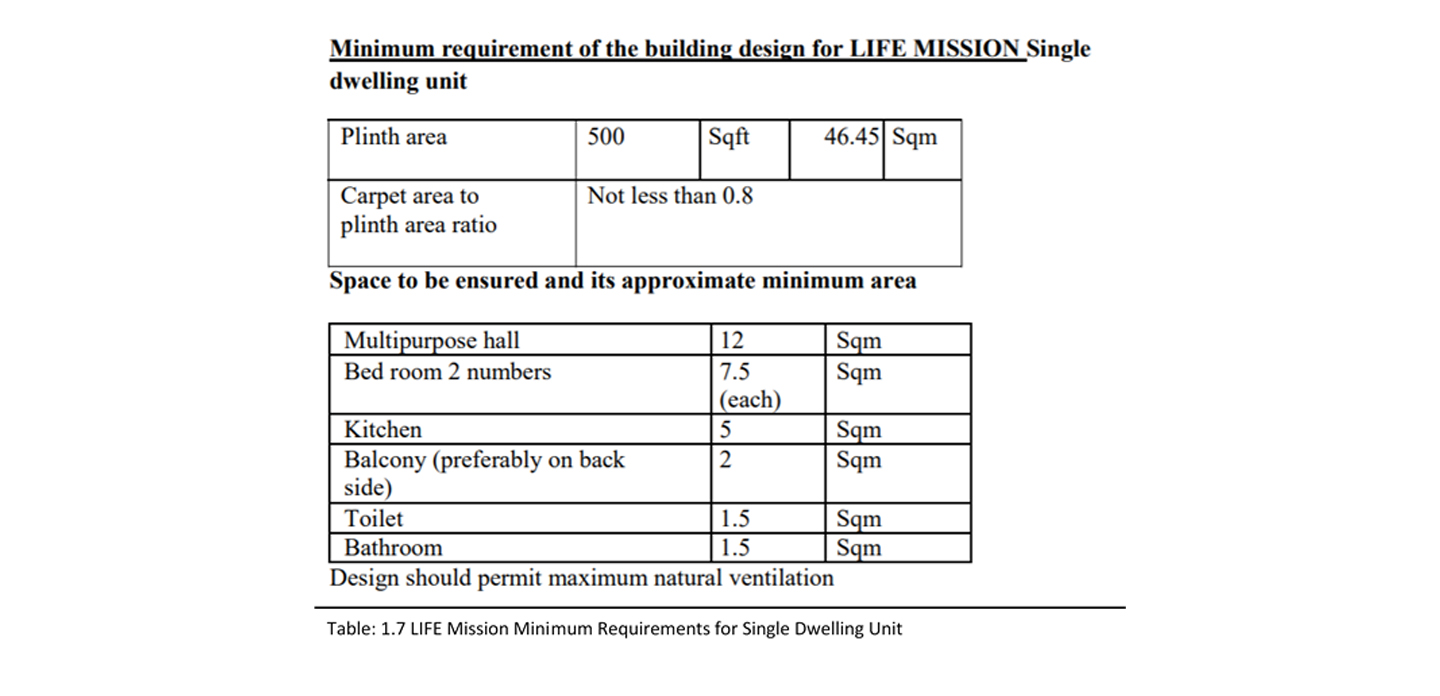

Mission LIFE (Livelihood Inclusion and Financial Empowerment) envisages a comprehensive housing scheme for all the landless and homeless in the State. Housing, being the very basic requirement that holds the key to accelerate social development in many ways, the Government of Kerala launched the LIFE.

The target of the mission is to provide safe housing to nearly 4.30 lakhs of homeless in the State within a period of 5 years. Among the homeless, about 1.60 landless families have been historically excluded from various housing schemes of the past. The programme is named as LIFE (Livelihood Inclusion and Financial Empowerment) Mission and the homeless will be provided with modern housing complexes with provision for pursuing their livelihoods, converging social services including Primary Health Care, Geriatric Supports, Skill Development and provision for financial services inclusion. The mission will also help those who received assistance from other schemes but could not complete the construction and move into a safe house.

| LIFE -House construction scheme – Beneficiary Data | |||

|---|---|---|---|

| Sl.no. | Panchayat Name | No of homeless having own land | Landless |

| 1. | Alangad | 118 | 491 |

| 2. | Chendamangalam | 245 | 113 |

| 3. | Chittattukara | 161 | 152 |

| 4. | Ezhikkara | 59 | 36 |

| 5. | Kadungalloor | 29 | 80 |

| 6. | Karumallur | 120 | 196 |

| 7. | Kottuvally | 172 | 207 |

| 8. | Kunnukara | 69 | 171 |

| 9. | Puthenvelikkara | 46 | 18 |

| 10. | Vadakkekkara | 174 | 87 |

| 11. | Varapuzha | 63 | 210 |

| Panchayat wise Data of beneficiaries under LIFE Scheme (source:lsgkerala.in) | |||

Beneficiaries

The LIFE Mission will benefit families with incomplete/dilapidated houses, families having semi-legal/semi-permanent houses in government land or in coastal regions families and families who are landless and houseless.

The priority would be given to the families under the following categories also:

- Destitute people

- Differently-abled

- Transgender

- Mentally challenged/paralyzed/blind

- Transgender

- Individuals suffering from fatal diseases

- Individuals who are unable to engage in livelihood activities due to accident or prolonged diseases.

- Unmarried mothers

- Widows

Selection Criteria

The social and economic caste survey will be conducted by the Central government will be considered to identify the beneficiary.

- The field level officers will address the identified beneficiaries for verification and submit the appropriate documents and details to local self-government institutions.

- The list of shortlisted beneficiaries will be published at District level or local Panchayat office.

Documents Required

The following are the documents to be produced at the time of applying for the scheme:

- Aadhaar Card

- Caste certificate

- Ration Card

- Income Certificate

- Voter Identity card

Assistance from Government

Under this project, the Kerala government will provide financial assistance to the houseless families with the area/land for construction of new houses at the rate of Rs.3.5 lakhs for the people belonging to the general category and Rs.4 lakhs to Scheduled Caste, plantation workers and fishermen. The beneficiaries belonging to the Scheduled Tribe category will be assisted with the actual cost for the completion of houses.

Also, the families owing dilapidated or incomplete houses will be granted with financial assistance for the construction of those houses, based upon the valuation done through Third Party Technical Agencies (TPTA).

Application Procedure for the Scheme

To register for Kerala Life Mission scheme, follow the steps mentioned below:

Step 1: Visit Official Website

- The applicant can directly approach the official portal of Kerala Life Mission Scheme.

Step 2: Login into Portal

- Firstly, the applicant needs to complete the initial login process. Click on the “Login” button which is visible on the home screen of the portal.

Step 3: Provide Login Details

- On the next page, enter the user name and password and click on “log in” button to access the portal.

Step 4: Registration Form

- Once the initial registration is completed, the applicant will have to register for the respective scheme.

Step 5: Fill the Details

- Fill the application form with the necessary details and save application along with the documents required.

Step 6: Verification of Form

- After submitting the form, the State Authority will verify and approve the beneficiaries to avail the benefits under the LIFE Mission scheme.

Pradhan Mantri Awas Yojana (PMAY)

Pradhan Mantri Awas Yojana (PMAY) is an initiative by Government of India in which affordable housing will be provided to the urban poor with a target of building 20 million affordable houses by 31 March 2022. It has two components: Pradhan Mantri Awas Yojana (Urban) (PMAY-U) for the urban poor and Pradhan Mantri Awas Yojana Rural (PMAY-G and also PMAY-R) for the rural poor. This scheme is converged with other schemes to ensure houses have a toilet, Saubhagya Yojana electricity connection, Ujjwala Yojana LPG gas connection, access to drinking water and Jan Dhan banking facilities, etc. The houses under Pradhan Mantri Awas Yojana would be constructed through a technology that is eco-friendly, while allotting ground floors in any housing scheme under PMAY, preference will be given to differently abled and older persons.

Eligibility Criteria

- Beneficiary max age 70 years,

- The beneficiary should not have an own dwelling unit on the name of any family member in any part of India.

- The loan applicant should not have availed any central/state government subsidy or benefit for buying a home under the PMAY scheme.

- Currently, the loan applicant should not own any property under their name and along with any of the family members (including the dependents).

- The home renovation or improvement loans, self-construction loans will be allocated only for EWS and LIG categories.

The following individuals and families are eligible for this scheme:

- Economically Weaker Section (EWS) – Families with an annual income up to Rs. 3 Lakh.

- Low Income Group (LIG) – Families with an annual income between Rs. 3 Lakh and Rs. 6 Lakh.

- Middle Income Group I (MIG I) – Families within an annual income between Rs. 6 Lakh and Rs. 12 Lakh.

- Middle Income Group II (MIG II) – Families with an annual income between Rs. 6 Lakh and Rs. 12 Lakh.

- Women belonging to EWS and LIG categories.

- Scheduled Caste (SC), Scheduled Tribe (ST), and Other Backward Class (OBC).

How to apply

Beneficiaries can apply for PMAY through the following:

A. Online

Individuals can visit the official website of the scheme to apply online. They need to have a valid Aadhaar Card to apply.

B. Offline

Beneficiaries can apply for the scheme offline by filling up a form available through Common Service Centre (CSC). Price of these forms is Rs. 25 + GST.

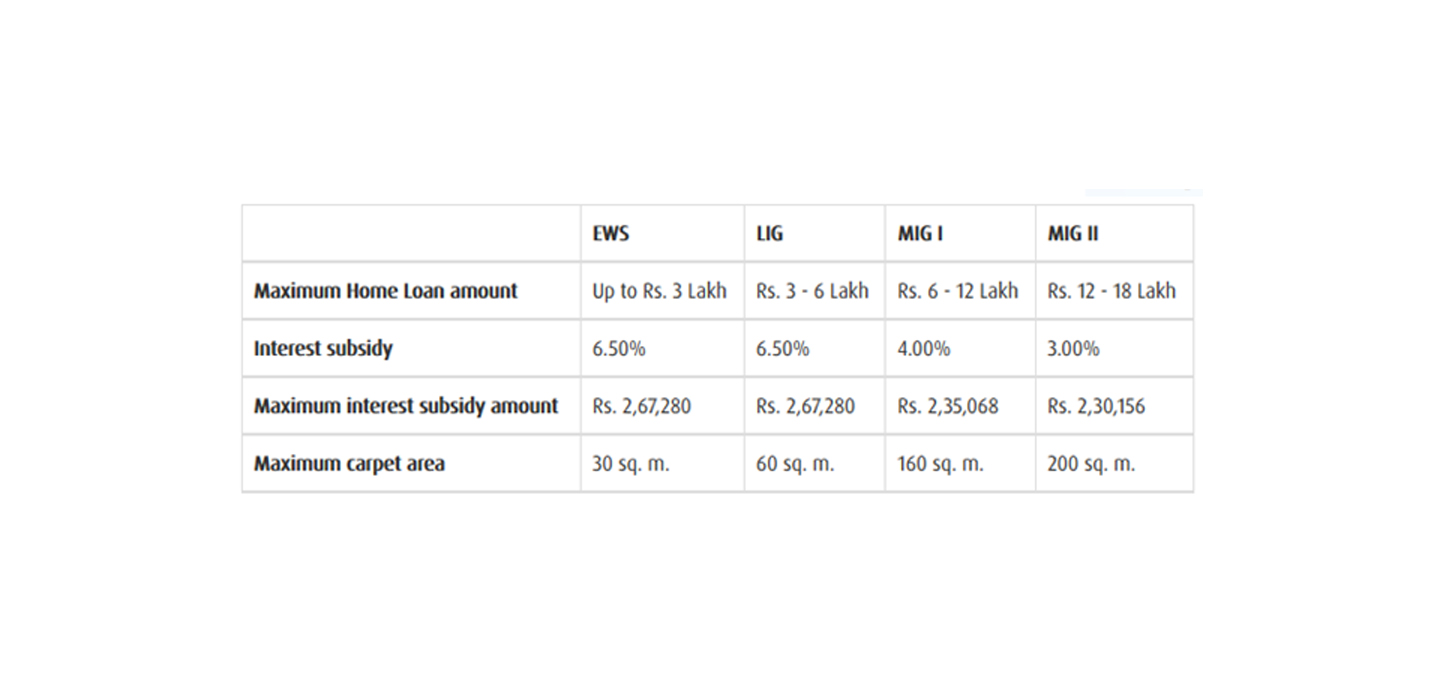

The PMAY subsidy rate, subsidy amount, maximum loan amount, and other details have been mentioned below:

PMAY details

The features of Pradhan Mantri Awas Yojana are that the government will provide an interest subsidy of 6.5% (for EWS and LIG), 4% for MIG-I and 3% for MIG-II on housing loans availed by the beneficiaries for a period of 20 years under credit link subsidy scheme (CLSS) from the start of a loan.

Convergence between PMAY and AUEGS

It is the initiative of Kudumbashree, State Poverty Eradication Division, Kerala. A PMAY beneficiary gets registered as a worker for the participation in the construction of their own house. Financial Assistance provided through PMAY (4 Lakhs) alone is not enough for the completion of construction. The beneficiary can receive an additional amount of Rs.24390 (Rs. 271 for 90 wage days).

Credit linked subsidy scheme

The Mission, in order to expand institutional credit flow to the housing needs of urban poor will implement credit linked subsidy component as a demand side intervention. Credit linked subsidy will be provided on home loans taken by eligible urban poor (EWS/LIG) for acquisition, construction of house.

- Beneficiaries of Economically Weaker section (EWS) and Low Income Group (LIG) seeking housing loans from Banks, Housing Finance Companies and other such institutions would be eligible for an interest subsidy at the rate of 6.5 % for a tenure of 15 years or during tenure of loan whichever is lower. The Net Present Value (NPV) of the interest subsidy will be calculated at a discount rate of 9 %.

- The credit linked subsidy will be available only for loan amounts upto Rs 6 lakhs and additional loans beyond Rs. 6 lakhs, if any, will be at nonsubsidized rate. Interest subsidy will be credited upfront to the loan account of beneficiaries through lending institutions resulting in reduced effective housing loan and Equated Monthly Instalment (EMI).

- Credit linked subsidy would be available for housing loans availed for new construction and addition of rooms, kitchen, toilet etc. to existing dwellings as incremental housing. The carpet area of houses being constructed under this component of the mission should be upto 30 square metres and 60 square metres for EWS and LIG, respectively in order to avail of this credit linked subsidy. The beneficiary, at his/her discretion, can build a house of larger area but interest subvention would be limited to first Rs. 6 lakh only.

- Housing and Urban Development Corporation (HUDCO) and National Housing Bank (NHB) have been identified as Central Nodal Agencies (CNAs) to channelize this subsidy to the lending institutions and for monitoring the progress of this component. Ministry may notify other institutions as CNA in future.

- Primary Lending Institutions (PLIs) can register only with one CNA by signing MoU as provided in Annexure 1.

- CNAs will be responsible for ensuring proper implementation and monitoring of the scheme and will put in place appropriate mechanisms for the purpose. CNAs will provide periodic monitoring inputs to the Ministry of Housing and Urban Poverty Alleviation through regular monthly and quarterly reports

- State/UTs/ULBs/PLIs shall link beneficiary identification to Aadhaar, Voter card, any other unique identification or a certificate of house ownership from Revenue Authority of Beneficiary’s native district to avoid duplication.

- Preference under the Scheme, subject to beneficiaries being from EWS/LIG segments, should be given to Manual Scavengers, Women (with overriding preference to widows), persons belonging to Scheduled Castes/Scheduled Tribes/Other Backward Classes, Minorities, Persons with disabilities and Transgender.

- State Level Nodal Agency (SLNA) identified by State/UT for implementing the mission will facilitate the identified eligible beneficiaries in getting approvals and documents, etc. to avail of credit linked subsidy.

- For identification as an EWS or LIG beneficiary under the scheme, an individual loan applicant will submit self-certificate/affidavit as proof of income.

- In case a borrower who has taken a housing loan and availed of interest subvention under the scheme but later on switches to another PLI for balance transfer, such beneficiary will not be eligible or claim the benefit of interest subvention again.

- Under the Mission, beneficiaries can take advantage under one component only. Since other three components are to be implemented by State Government through Urban Local Bodies/Authorities etc. and this component is to be implemented by PLIs, therefore, in order that beneficiaries do not take advantage of more than one component, PLIs should take NOCs quarterly from State/UT Governments or designated agency of State/UT Governments for the list of beneficiaries being given benefits under credit linked subsidy. For enabling this process, the beneficiaries should be linked to his/her Aadhaar/Voter ID Card/Any other unique identification Number or a certificate of house ownership from Revenue Authority of Beneficiary’s native district and State/UT Government or its designated agency should furnish the NOC within 15 days of receipt of such request

Kerala Panchayat Building Rules, 2019

Short title, applicability and commencement.-

- These rules may be called the Kerala Panchayat Building Rules (KPBR), 2019.

- They shall apply to area under all Village Panchayats in the State.

- They shall come into force at once.

Applicability:-These rules shall apply to:-

- Any public or private building as described below, namely:-

- Where a building is newly erected, these rules shall apply to the designs and construction of the building;

- Where the building is altered, these rules shall apply to the altered portion of the building;

- Where the occupancy or use of building is changed, these rules shall apply to all the parts of the building affected by the change;

- Where addition or extension is made to a building, these rules shall apply to the addition or extension only

Essentiality of permit :-

- No person shall develop or redevelop any parcel of land by subdividing into plots or cause the same to be done without first obtaining a permit for each such development or redevelopment from the Secretary.

- No person shall construct or reconstruct or make addition or extension or alteration to any building or cause the same to be done without first obtaining a building permit for each such work from the Secretary.

- No person shall change the occupancy of an existing building from one group to another, without first obtaining the permit from the Secretary.

- Provided that the Secretary shall issue permit for Single family residential buildings up to 300 m2 of build-up area coming under Coastal Regulation Zone, in accordance with the provisions of the relevant Coastal Regulation Zone notification in force.

Permit not necessary for certain works –

Not withstanding anything contained in these rules, no building permit shall be necessary for executing the following works which do not otherwise violate any provisions regarding general building requirements, structural stability and fire safety requirements of these rules, namely:-

- Providing or removing of windows or doors or ventilators;

- Providing inter-communication doors;

- Providing or removing of partitions without any structural alteration;

- Gardening excluding any permanent structures;

- White or colour washing;

- Painting

- Petty repairs to the building and pitched roof;

- Plastering and patch work;

- Interior decoration without any structural alterations; and

- Changing of the location of the building or construction within the plot;

- Compound wall not abutting a public street;

- Huts, except huts adjacent to roads mentioned in section 235P of the Kerala Panchayat Raj Act, 1994;

- Single family residential buildings in Category –II Village Panchayats under Group A1-Residential occupancy with total built-up area on all floors up to 100 sq. metres (including existing and proposed within the plot) and the number of storeys limited to two.

Transfer of plots to be intimated –

- Every person holding development permit or building permit shall, unless the work has been executed in full and development or occupancy certificate obtained, inform the Secretary, every transfer of the whole or part of any property involved in the permit together with the name and address of the transferee and his intention to transfer or otherwise of the permit.

- Every person, in whose favour any property is transferred along with a development or building permit by the transferor, shall before commencing or continuing the work obtain permit of the Secretary in writing.

- The request for permission to commence or continue work shall be submitted in white paper along with documents, together with document regarding the ownership and possession certificate and fee of Rs100.

- The Secretary shall, if convinced that the transfer will not in any way badly affect the development or construction, issue permission in writing, transferring the permit and allowing the commencement or continuation of work, within 15 days from the date of receipt of the request.

- Permit issued becomes invalid if part of the plot included in the approved plan is transferred / sold to any other person.

- No land development or redevelopment shall be made or no building shall be constructed on a plot notified by Gram Panchayat which is liable to be flooded or on a slope forming an angle of more than 45 degrees with horizontal or on soil unsuitable for percolation or on area shown as floodable area in any Master Plan / Detailed Town Planning Scheme / Interim Development Order in force under the Kerala Town and Country Planning Act, 2016 (9 of 2016)or in sandy beds, unless it is proved by the owner to the satisfaction of the Secretary that construction of such a building will not be dangerous or injurious to health and the site will not be subjected to flooding or erosion or cause undue expenditure of public funds for providing sewers, sanitation, water supply or other public services.

- No construction shall be made to obstruct the natural drains and streams in a plot. Failure to comply with this instruction will invite penalization under Section 51 of the Disaster Management Act, 2005 (Central Act 53 of 2005).

- Construct any building other than compound wall or fence or outdoor display structure within 3 meters, from any plot boundary abutting national highways, state highways, district roads, other roads notified by Panchayat, other un-notified roads with width 6m and above