What is Financial Literacy?

Financial literacy is the ability to use skills and knowledge to take effective and informed money-management decisions. For India, financial literacy and awareness on financial opportunities is vital to promote financial inclusion and ultimately financial stability.

The Objectives of Financial Literacy:

- To inculcate habits of savings

- To help people in financial planning /household budgeting

- To help /build capacity and ability to borrow loan from different financial institutes/banks

- To understand and plan family budgeting

- To understand savings and options

- To understand investment and options

- To understand banking and different aspects

- To understand financial aspects in Loan

- To understand loan capacity

- To understand debt management

- To sustain financial growth by linking with income generation activities and self-help groups

IMPORTANT DEFINITIONS AND TERMS

INCOME: Money earned from various sources like salary, wages, earnings or profit from farming, business, investment etc. is our income.

| Income | Rs. (Amount) |

|---|---|

| Salary of husband | 10000 |

| Salary of Wife | 3000 |

| Pension of father | 2000 |

| Earning from agriculture sale | 4000 |

| TOTAL INCOME | 1900 |

| 0 |

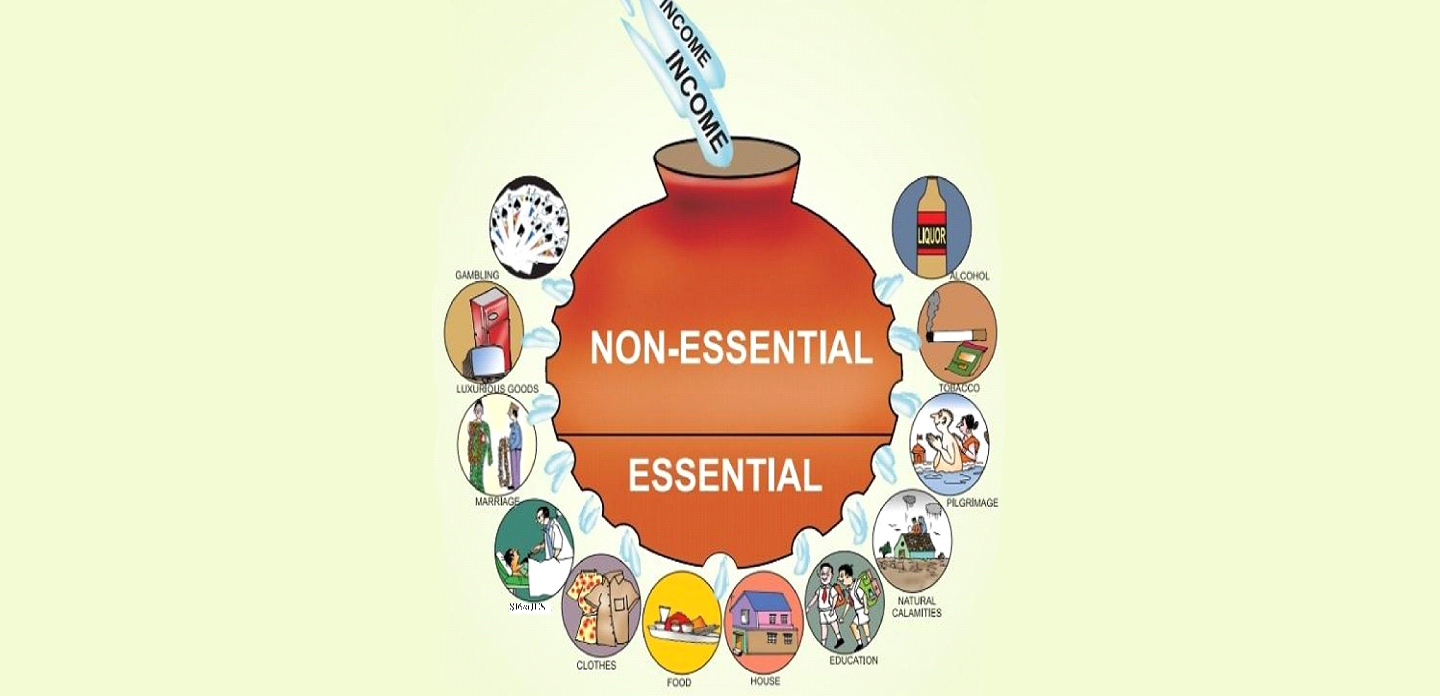

EXPENDITURE: Money spent on essential and non-essential items is expense

| Expense | Rs. (Amount) |

|---|---|

| Food, shelter, Clothes | 10000 |

| Education | 2000 |

| Repayment loan | 2000 |

| Sickness | 1500 |

| Drink, drugs, Gutka | 1200 |

| Excessive expenses on Marriage, Festivals, Pilgrimage etc | 500 |

Let’s understand what’s essential and non-essential expenses through the poster below:

As per a global survey by Standard & Poor’s Financial Services LLC (S&P) less than 25% of adults are financially literate in South Asian countries. For an average Indian, financial literacy is yet to become a priority. India is home to 17.5% of the world’s population but nearly 76% of its adult population does not understand even the basic financial concepts.

Read MoreAccording to the 2011 Census, there were 1.77 million homeless people in India, or 0.15% of the country’s total population. There is a shortage of 18.78 million houses in the country (as per 2011 census). Similarly, India, the world’s second-largest country by population, has the highest number of people (732 million) without access to toilets, according to a new report by Water Aid, titled Out Of Order. It further stated that 355 million women and girls lack access to a toilet. The report also explains open defecation and lack of toilet facility as a major cause for stunting, diarrhoea deaths and anaemia mainly among children below five years of age.

Read MoreMinistry of Urban development provides Rs.4000 to construct a toilet with an additional incentive share from state government under Swatch Bharat Mission. Ministry of Drinking Water and Sanitation provides Rs.12000 as incentive per toilet for construction of individual household latrines. However, individual may need more funds to construct house or toilets as per his and his family priority or for additional services like water and electric connection, water tank fittings, construction of bathroom, tiles in the toilet, additional room or floor, colour or tiles in the house etc. For this one may seek help for financial assistance from different sources if he has knowledge on it.

Read MoreWhat is MDI (Monthly Disposable Income):

Disposable income is the amount of net income a household or individual has available to invest, save, or spend after deducting all expenses including income taxes, debts, liabilities, food expense, school fee, transport expenses, rent etc.

Read MoreBy managing the balance between income and expenses, we can avoid falling in the trap of debts. If we learn not to spend more than our income we can save money and invest in bank or other options for savings.

Read MoreTaking care of income and expense balance carefully is called financial planning. Let’s understand the picture on essential and non-essential expenses. There are expenses which are mandatory like food, cloths, housing , education, marriage, illnesses etc.

Read MoreAfter determining the family and personal goals we can also maintain a financial diary to ease financial planning. The Vices can be avoided, Wants can be reduced and needs to be met but should always be limited.

Read MoreIn emergencies when our income is less than our expenses we tend to borrow debt from individuals, institutions and traditional money lenders. The stagnant income doesn’t give us any saving but this debt and associated interest increases burden of loan and repayment.

Read MoreOne needs to answer few questions before deciding on investing on housing or sanitation infrastructure:

Read MoreThe Pradhan Mantri Awas Yojana (PMAY) Credit Linked Subsidy Scheme (CLSS) – ‘Housing for All’ is a home loan scheme launched by our honourable Prime Minister Shri Narendra Modi. The scheme envisions ‘Housing for All’ by the year 2022. It benefits people belonging to the Economically Weaker Section (EWS), Low Income Group (LIG), Middle Income Group-I (MIG-I), and Middle Income Group-II (MIG-II) of society. Beneficiaries availing this scheme are eligible to avail interest subsidy on the purchase or construction of a house or the enhancement of dwelling unit.

Read MoreThe borrower can apply for the Housing Loans and CLSS subsidy through the PLIs (Prime Lending Institutions, banks etc.). This institutions/banks perform due diligence and check the fulfilment of the eligibility criteria for the scheme, then the required criteria are satisfied they submit the borrowers claim to Central Nodal Agency (CNA). The CNA processes the claim and releases the subsidy amount through that institute/bank. The institute/bank adjust the same by crediting to the borrower’s Loan account resulting in reduced loan outstanding and the effective EMI.

Read More